Solutions

Sanction screening

Stop sanction penalties. Protect your business with automated payment compliance. Build a compliant process.

Nomentia Sanction Screening secures compliance and global market access

Protect your business from legal, financial, and reputational risks.

Prevent fines and penalties

Check outgoing payment compliance automatically to protect your business from legal and financial consequences.

Guarantee compliance

Screen your payments against international sanctions list, flag violations, and stop risky transactions.

Secure business continuity

Protect your business reputation amidst increasing regulation and secure market access.

Build enforceable processes

Routinely monitor partners, suppliers, and other stakeholders to verify due diligence and compliant “Know Your Customer” process.

Build risk-free payment processes

Screen and identify

Make transaction compliance faster and more efficient with automation.

- Automatically verify payments against international sanctions lists.

- Process payment data through Nomentia’s sanctions screening solution.

- Use advanced algorithms to identify partial matches and similar names.

- Detect potentially high-risk payment recipients efficiently.

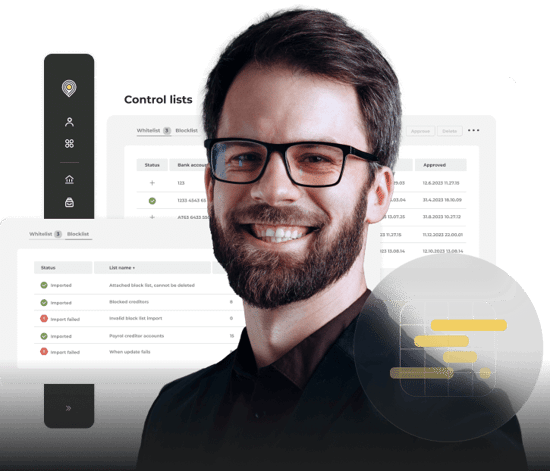

Flag, alert & review

Nomentia's advanced algorithm improves match accuracy and reduces false positives and negatives.

- Flags non-compliant payments and generates alert for review.

- Evaluate all potentially non-compliant transactions.

- Manage true hits and false positives efficiently with whitelisting.

Make risk-free payments

Prevent payments to sanctioned individuals and entities.

- Ensure compliance by mitigating legal and financial risks

- Avoid negative publicity and protect your company’s reputation.

- Maintain market access and contract eligibility.

- Reduce legal fees and remediation costs.

Improve operational efficiency

Establish a foundation for customer on-boarding due diligence.

- Develop a dynamic compliance process and robust due diligence framework that adapts to evolving regulatory requirements.

- Continuously monitor and update your compliance protocols to address new sanctions and risks, ensuring all transactions are screened effectively.

- Strengthen your due diligence efforts and manage compliance risks

- Maintain trust with partners and stakeholders.

Trusted by 1400+ customers worldwide

Sirkku Markula

SVP, Corporate Treasurer, Kone

![]()

"We were in need of a global tool that could be used in all of our locations for all of our payments. The goal was to create a harmonized way of working. One of the main drivers was security: we wanted to improve the safety of our cash outflows and simplify user rights management.”

Sirkku Markula

SVP, Corporate Treasurer, Kone

Integrate with the tools

you rely on every day

Nomentia integrates with the banks, systems and tools you use everyday.

Find out more