Summary. A payment hub solution is a key technology to centralized cash management. Fragmented payment systems, manual payment processes, and the lack of real-time cash flow visibility pose significant challenges that can quickly lead to inefficiencies and risk management issues. In this article, based on our chat with a treasury expert Pia Charron, we're answering questions on how to implement a payment hub and what are the best practices in payment hub implementation.

We cover what a payment hub is in detail in this article, top 9 best payment hub solutions in 2024 here, and how to choose a payment hub solution here.

As the financial landscape evolves ever more rapidly, many finance professionals are looking to implement a payment hub to streamline cash management processes and payment operations. To delve deeper into this topic, I had the privilege of interviewing Pia Charron, a lead consultant at Nomentia with over two decades of experience in treasury and cash management systems.

With her extensive expertise, Pia provided invaluable insights into the intricacies of payment hub implementation and the key factors driving its success.

Meet Pia Charron: A treasury expert

Pia's journey in the realm of treasury began over 20 years ago and with an extensive experience like that, there’s precious little she doesn’t know about implementing cash management and payment management systems.

At Nomentia, she plays a pivotal role as a lead consultant, guiding clients through their cash management projects. Whether it is working with large multinational corporations or SMEs, Pia's expertise spans various sectors, offering tailored solutions to meet each client's unique needs.

Payment hub in effective cash management

Today’s finance professionals face increasing challenges from fragmented payment systems, manual processes, and lack of real-time visibility into cash flows. It’s well known that this can result in inefficiencies, errors, and difficulties in managing liquidity and risk effectively. As things stand, it’s no wonder that forward-looking finance professionals are considering implementing a payment hub that can centralize payment operations, automate manual tasks, and gain real-time visibility into financial transactions.

“Payment hubs are piece of key technology to built a risk-aware, efficient and accurate controls in payment operations.”

During our chat, Pia emphasized the critical role these hubs play in enhancing efficiency and accuracy within cash management systems. By centralizing payment operations, businesses are able to significantly reduce errors and manual work while gaining better control over their financial processes. But success in payment hub implementation, as in so many other things, depends on having a clear understanding of what customers want and what they need.

At the heart of payment hub implementation is the need for organizations to consolidate their payment operations. Instead of dealing with multiple banking platforms and disparate systems, a payment hub integrates all payment activities into a single, cohesive system. Central to any successful payment hub implementation is understanding how these diverse customer needs are recognized and fulfilled. Pia highlighted two primary categories of customer requirements: those seeking centralization and efficiency, and those aiming for visibility and control over their payment ecosystems. Whether it's a multinational corporation or an SME, the customer's goals dictate the approach to payment hub implementation.

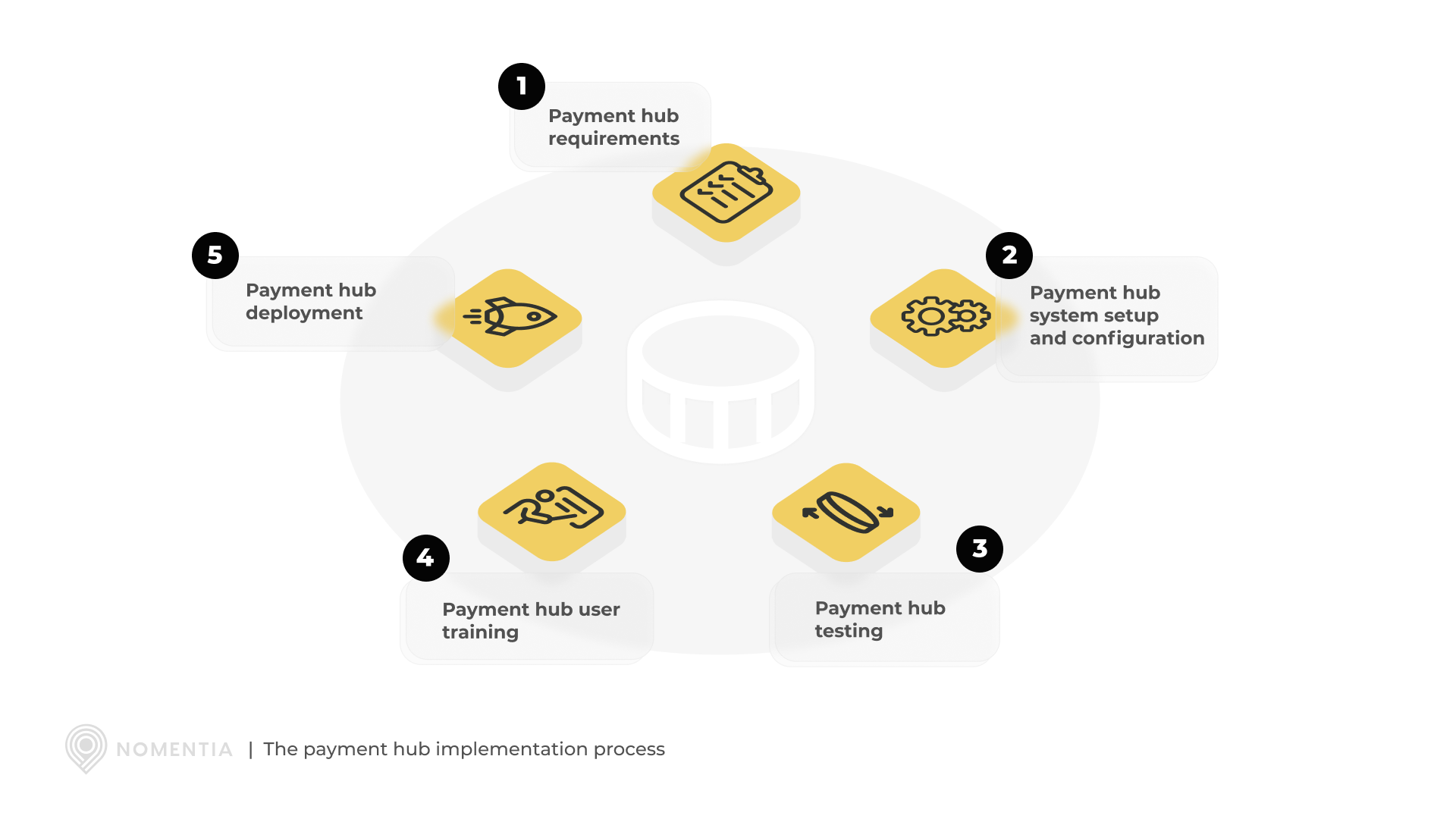

The payment hub implementation process

Although each business has its own goals and requirements, all payment hub implementations start from the same situation; with an understanding of three key things: First, what goals the customer has for their payment operations; secondly, analyzing their current payment ecosystem and processes; and finally, collaborating to devise a strategy on how customer’s goals can be achieved through the implementation of a payment hub:

- Payment hub requirements: To get your payment hub up and running you have to start by defining the specific requirements for the payment hub implementation, including master data, required bank connections, necessary user roles, and security controls.

- Assess your payment infrastructure: Payment hub implementation starts with understanding your current systems, processes, and data flows to see how the payment hub fits in and what integration points are needed. Pay special attention to banks, bank connections, and connectivity types that need to be assessed and accounted for. Negotiate with your banks whether they can provide automatic bank statements and at what cost.

- Payment hub system setup and configuration: Once the scope of your payment hub is settled, next up is setting up and configuring your payment hub system based on defined requirements.

- Plan your payment hub integration strategy: Once you know what’s needed you should determine how the payment hub will interface with existing systems like ERP, accounting, and CRM platforms. Seek guidance from experienced partners if needed.

- Data migration and system configuration: Cleanse and prepare data for migration, then configure systems to accommodate new payment processes and workflows.

- Payment hub testing: Before being deployed, your newly set up payment hub requires rigorous testing to ensure the system functions as intended and meets requirements.

- Payment hub user training: The key component to effective payment hub implementation is training the admin users who can best communicate and engage internal stakeholders and train payment hub end-users on how to use it effectively.

- Payment hub deployment: Once the testing of your new centralized payment hub is done and users are trained it’s time to go live.

- Continuous improvement: Iterate and improve the payment hub based on feedback and evolving needs, ensuring long-term value and efficiency.

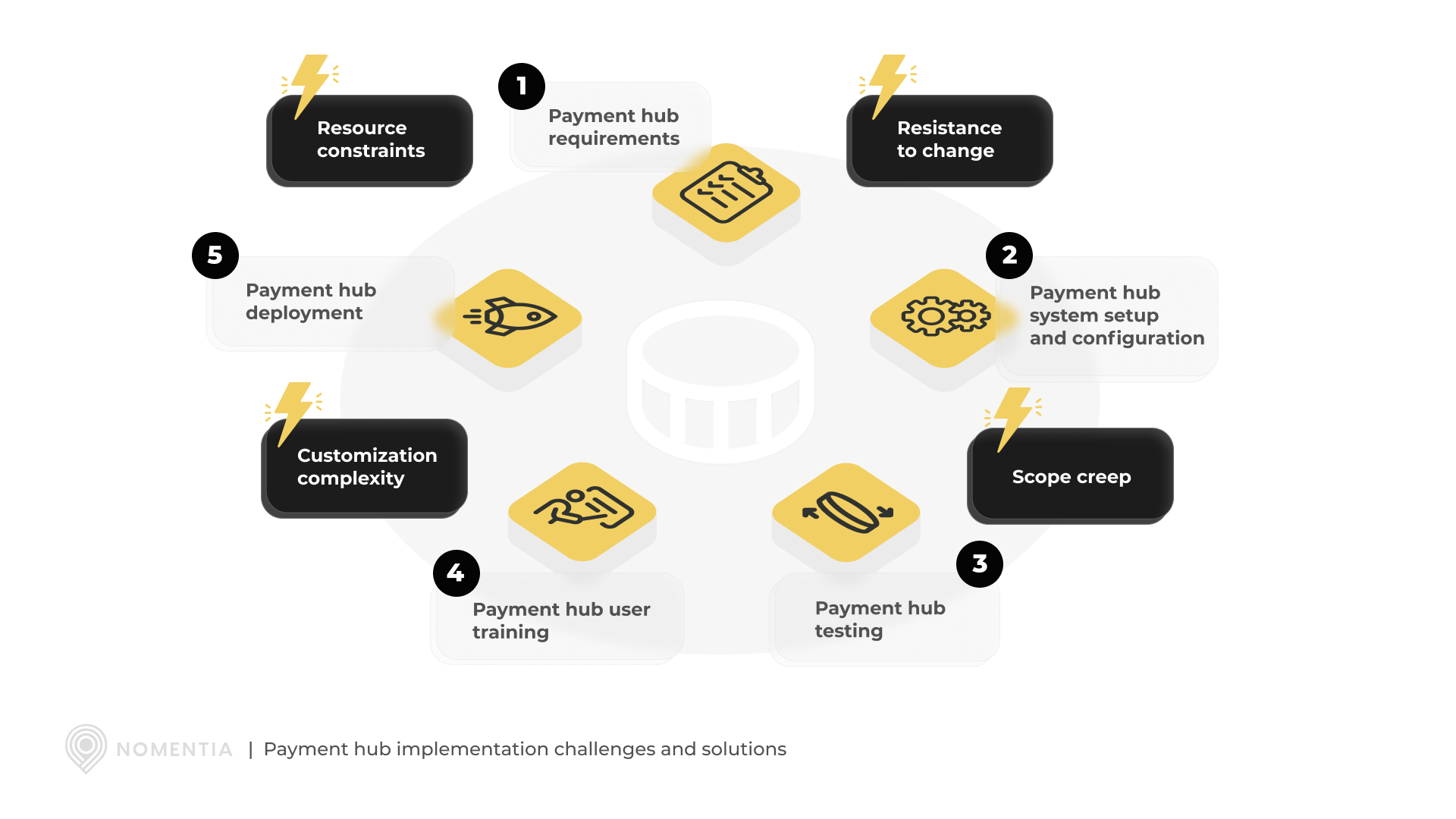

Payment hub implementation challenges and solutions

Despite the benefits, payment hub implementation comes with its own set of challenges. As Pia emphasized during our interview, these challenges often stem from the complexity of integrating the payment hub with existing systems and processes, which can require meticulous planning and coordination. We've covered payment hub implementation challenges extensively here.

"Success in payment hub implementation requires clear vision and expectation management."

The hunt for the payment hub implementation best practices

Unlocking the full potential of payment hub implementation requires a deep understanding of industry standards, technical prowess, and collaborative engagement with seasoned professionals. As Pia highlighted: The value of an experienced payment hub provider lies in their comprehensive grasp of not only the pain points faced by finance and treasury professionals during payment hub implementation but also the technical intricacies of payment hub technology. Moreover, it's crucial for them to possess the ability to listen attentively and comprehend not just the customer’s needs but also the most efficient way to assist them in achieving their objectives.

“Precise, accurate and controlled payment processes sit at the heart of strategic cash and treasury management.”

Cash management and treasury management are indispensable functions that underpin strategy, sustainability, and liquidity. Within this framework, the payment hub emerges as a vital technology. While seasoned finance and treasury professionals typically have a clear vision of their requirements, they greatly benefit from collaborating with experienced counterparts on the vendor side. These cash and treasury technology experts can offer insights gleaned from not only a few but hundreds and thousands of implementation projects that are all business-critical. This depth of experience and expertise is essential for navigating industry standards and anticipating future developments. Hence, when seeking guidance on best practices in payment hub implementation, Nomentia consultants draw from their wealth of experience to offer recommendations that consistently garner the trust and acclaim of our customers, as evidenced by our customer reviews.

Top 3 frequently asked questions about payment hub implementation

The complexities of payment hub implementation can seem daunting, but they are by no means impossible to manage. While there are challenges to be faced and critical factors to consider payment hub implementation projects can be successfully navigated if approached with a willingness to learn from the process. You don't have to reinvent the wheel, just pay heed to what you can learn from others.

1. What are the key challenges organizations face when implementing a payment hub?

2. What are the critical factors for successful payment hub implementation?

3. What are the key stakeholders in the payment hub implementation process?

Extra: What’s the key to a successful payment hub implementation?

Payment hub implementation insights from a treasury expert

As the financial landscape evolves, finance professionals are turning to payment hubs to streamline cash management and payment operations. Fragmented payment systems, manual processes, and lack of real-time cash flow visibility pose significant challenges, leading to inefficiencies and risk management issues. To reach their goals, forward-thinking finance experts are implementing payment hubs to centralize operations, automate tasks, and achieve real-time transaction visibility.Read more about payment hubs:

- Payment hubs vs. banking portals

- The challenges and business impacts of implementing a global enterprise scale payment hub

- How to choose the right payment hub solution

- Can a payment hub help you tackle fraud?