Every company needs to make payments, either through banking portals or payment technologies. In this article, we'll compare what it's like to manage payments through bank portals versus in a payment hub. We'll also elaborate on the pain points of using traditional corporate e-banking tools and the key benefits and features of using payment hubs. Lastly, we provide some guidance on selecting a solution that suits your company's needs.

What is a payment hub?

A payment hub is centralized software that consolidates company-wide payments by gathering data from multiple payment initiating systems, such as ERP, banks, treasury, accounting, or financial systems. It streamlines payment procedures, enabling transactions across various banks and channels from one platform. This centralization enhances efficiency, reduces manual errors, improves visibility and control over financial operations, and ultimately optimizes cash management while reducing costs associated with manual work.

How do online banking portals work for payments?

Companies pay their bills through banking portals by setting up transfers from within the bank account, similar to wiring money in retail banking. In corporate banking, it usually starts with an invoice, salary payment or other form of credit that someone in the finance or accounting team verifies. Then, a person responsible for payables logs in to the company's online banking portals and sets up a transaction that corresponds with this data.

Typically, companies need to log in to several banks to minimize the risk of having only cash in one account at one bank. Yet, this also means that cash is divided over various bank accounts. Hence, payables need to be made from various banks, each requiring a separate login. This process can become very time-consuming with numerous banks, and it is also more challenging to see how much cash is available for payments since cash is spread over various accounts without central visibility.

What is the difference between a payment hub and an online banking tool?

A payment hub is offered by a specialized payments provider that has build a technology that can be used by companies for company-wide payments across all banks from a single place. In contrast, online banking portals are offered by banks and are essentially just a way to manage bank accounts, payments, and all other associated administration that comes with corporate accounts.

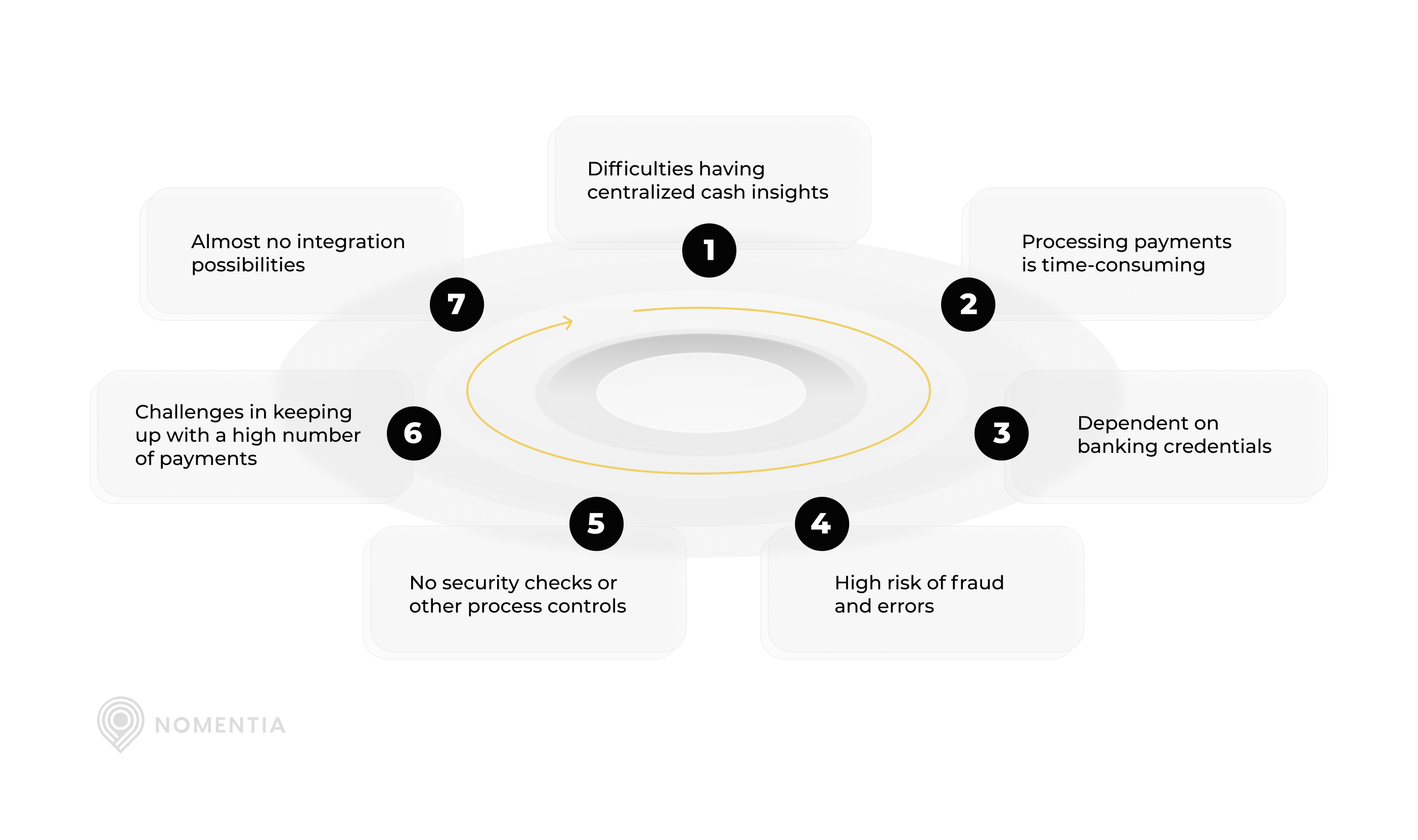

The most common pain points without a payment hub

There are several pain points associated with setups that do not include a payment hub, especially when companies start growing in size with an increasing number of payments from various bank accounts. These are some of the most common ones that our customers have faced before implementing a hub:

1. Difficulties having centralized cash insights

When cash balances are scattered over various bank accounts, it is incredibly difficult to say what the company's current cash positions are, although this can be of great strategic importance. On top of that, it is difficult to track in and outflows when this data is distributed.

2. Processing payments is time-consuming

Another challenge that finance, treasury, or accounting teams face with online banking portals is that all payments must be made manually and individually in each portal, which is incredibly time-consuming with tens, hundreds, or thousands of daily payments.

3. Dependent on banking credentials

As your team expands, managing users will become increasingly complex, as banking portals often require various tokens to log in. Unfortunately, these tokens are usually still physical devices, so you're highly dependent on always bringing them with you. Suppose you need to access 10 bank accounts you may need 10 different tokens, and when traveling around, or even just between home and the office, that can be quite inconvenient.

4. High risk of fraud and errors

Manual payments via banking portals are prone to errors since every transaction requires manual data entries. Erroneous payments have dire consequences for company finances. Fraudulent payments are also much harder to identify since you need to review all payments manually to see if there are any potential anomalies.

5. No security checks or other process controls

Whenever you make payments from a banking portal, you miss some critical steps that payment hubs can offer automatically. Or, if done manually, it becomes very time-consuming. These steps include security checks in payment processes to tackle fraud, prevent errors, enhance matching, or screen against sanctions—something that programmed computers can do easily and much more efficiently.

6. Challenges in keeping up with a high number of payments

As mentioned before, the more payments you need to execute through different banking portals, the more time you spend on doing so. Sometimes, this means that it's challenging to keep up with the number of payments. Rather than tackling the issue by hiring more people, it is very common to get automated payment technology that can easily help you streamline processes.

7. Almost no integration possibilities

Banks themselves offer very limited integration possibilities with financial, accounting or ERP systems, therefore processes cannot be automated properly. Yet, these same systems contain crucial information for finance, accounting, and treasury teams' payment operations. Ideally, they are fully integrated with banks to provide a central source of truth. While this is partially possible through building bank connections with banks, this requires a lot of work from your team and several IT specialists. A dedicated technology that handles everything is therefore a lot easier to manage.

The benefits of using a payment hub

Companies can benefit in multiple ways from using a payment hub, some of the most mentioned benefits include:

-

Centralization of payments, tasks, and data

One of the primary reasons for acquiring a payment hub is its ability to centralize all payment files, irrespective of the banks or source systems that are involved. It connects to all your bank accounts via the most appropriate connectivity protocols, enabling you to execute payments centrally and access all relevant cash flow data from the same system. This gives you better control over your finances and helps you streamline your payment processes.

-

Cost and time savings

Automating and centralizing payment processes can help you save a substantial amount of time. This can also lead to long-term savings on labor costs. Additionally, payment hubs enable automatic security checks that help mitigate payment fraud and errors, leading to financial benefits.

-

Enable visibility into cash flow

When payments are processed through a centralized system, it allows the payment hub to keep track of your cash outflows in detail. This provides you with easy access to valuable cash flow information. Additionally, patterns and recurring transactions can be easily identified and included in liquidity or cash flow forecasting reports if the tool allows this.

-

Less reliance on technical support

It is the payment hub providers who are responsible for creating and managing the link between their solutions, banks, and ERP systems. This means that treasury teams do not require technical specialists to establish or maintain bank connections. Furthermore, SaaS companies offer their solutions as a service and provide user and implementation support to alleviate the treasury team from a lot of technical work.

-

Fraud and error detection

As mentioned earlier, payment hubs typically have automatic fraud and error detection processes in place. Every payment is screened against these rules, making payments much safer without compromising efficiency.

-

User management

Managing users becomes much simpler with a payment hub, just like with most other technologies. All users can be managed centrally, and certain privileges can be added or removed from each user with ease. Some tools even integrate workflows with HR systems that automatically add or remove users whenever an employee joins or leaves the organization.

-

Ready to scale

Payment hubs can be implemented gradually, based on subsidiaries, banks, countries or other parameters. They are highly flexible and scalable. We have seen cases where mergers and acquisitions occur or where thousands of bank accounts need to be included in the payment centralization process, and it does not pose any challenges. It may take more time to implement or expand, but once set up, it goes relatively smoothly.

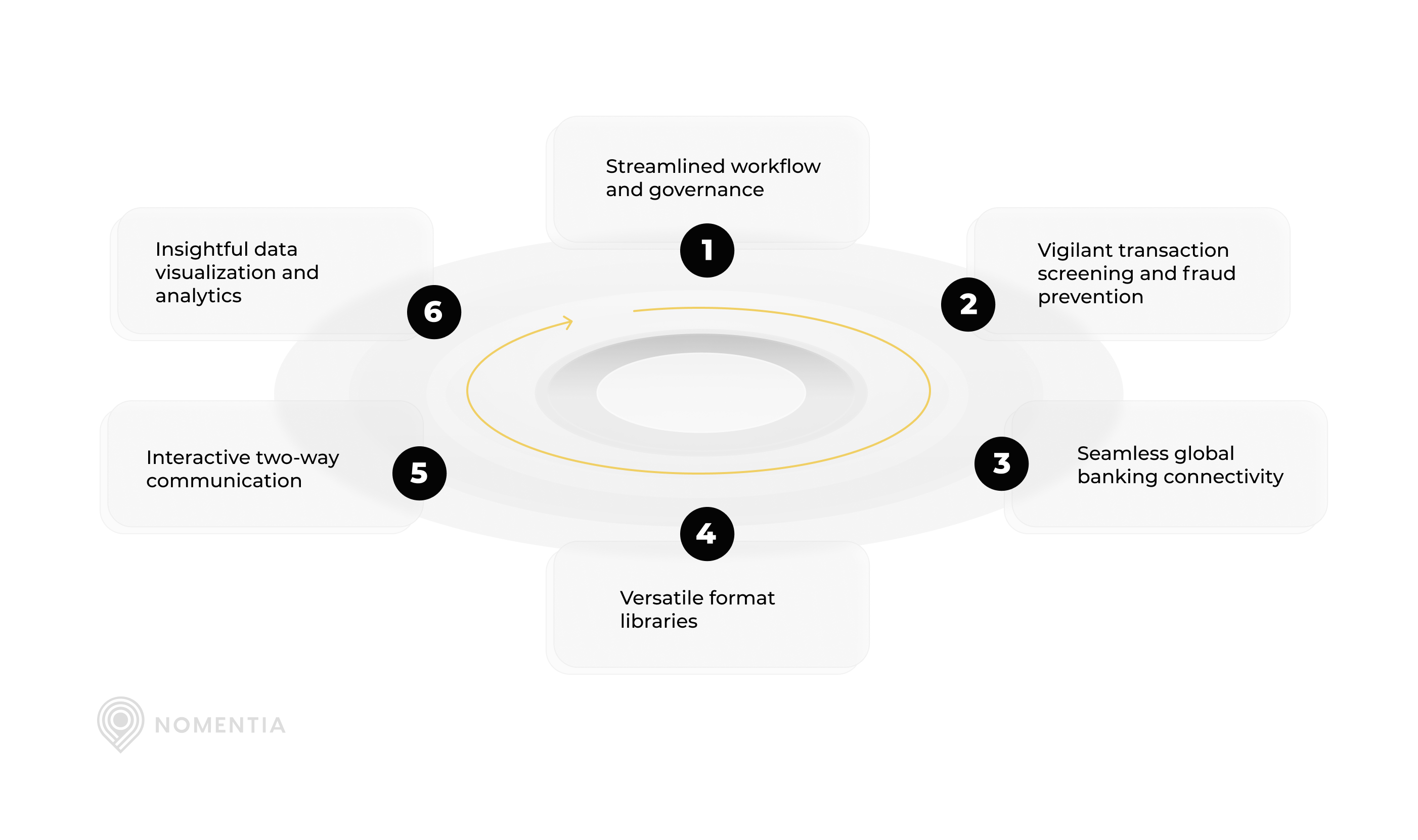

Key functionalities of a payment hub

It is important for a corporate payment hub to have critical features that can be customized to specific needs when necessary. These are some of the main features of payment hubs:

- Streamlined workflow and governance: a large number of transactions usually follow the same set of rules and processes to ensure compliance with policies. However, to future-proof your payment processes, it's also critical to ensure that single manual payment (they are sometimes necessary) processes adhere to the organization's payment policy and standardized controls. This isn't always a given.

- Vigilant transaction screening and fraud prevention: employing real-time screening mechanisms to safeguard against unauthorized transactions, errors, and fraudulent activities.

- Seamless global banking connectivity: facilitating integration with banks worldwide, offering standardized interfaces regardless of the banks the hub is connected with.

- Versatile format libraries: payment hubs adapt to the diverse requirements of global banks by accommodating a wide array of format variations effortlessly.

- Interactive two-way communication: enabling efficient exchange of payment acknowledgments, tracking updates, and bank status reports for enhanced transparency.

- Insightful data visualization and analytics: empowering finance and treasury teams with comprehensive data visualizations and advanced analytics tools for informed decision-making and strategic planning.

How to select a payment hub

With many different vendors of payment hub solutions on the market, finding the right solution for your team can be time-consuming and challenging. Here are a few helpful tips when you are looking for a solution:

- Start by listing your requirements and then consider how the functionalities of the different vendors meet your needs.

- Ensure the hub can connect to all your necessary bank accounts and systems, like ERPs or account software.

- Since you will be managing a lot of sensitive data, you need to consider the security levels vendors can offer, both from an organizational perspective and by examining the security features of their systems.

- Last but not least, evaluating the level of support offered by the vendor during and after the implementation process is crucial, as challenges can occur, and end-users may have frequent inquiries.

We have also dedicated an entire article to the process of choosing a suitable payment hub, which you can find here: how to choose the right payment hub solution.

Corporate banking portal tools or a payment hub? The verdict

Opting for a payment hub over e-banking portals ensures centralized control, streamlined processes, and enhanced security for corporate payments, with features like standardized workflows, real-time fraud detection, and global bank connectivity. Additionally, payment hubs offer greater flexibility, scalability, and insights through features like pre-built format libraries and advanced analytics, surpassing traditional banking portal capabilities.