The global trade finance ecosystem accounted for approximately 5.2 trillion dollars in 2021 alone. With international trade ecosystems growing, supply chains worldwide are affected increasingly. Most larger companies today are engaging in some form of international trade and therefore deal with various counterparties daily. Even smaller and mid-sized companies cannot escape international trade any longer.

As a result, trade finance has also become an increasingly important topic in treasury and finance because it helps facilitate the trade of goods and services around the world. However, even though global trade has been developing rapidly over the past decades, trade finance processes remain outdated and administratively heavy, with lots of paper-based manual work. As a result, trade finance can quickly become unmanageable for companies trading many goods and services.

Several vendors have developed systems to help companies overcome trade finance challenges and streamline and digitalize their trade finance operations throughout the entire process. We have compiled some of the benefits of trade finance software and a list of the best providers available on the market.

What is trade finance software?

Trade finance software is designed to help organizations manage trade finance operations more efficiently. It offers functionalities such as end-to-end process automation and digitalization and consolidates all trade finance instruments and products and counterparty information in one place.

Benefits of trade finance software

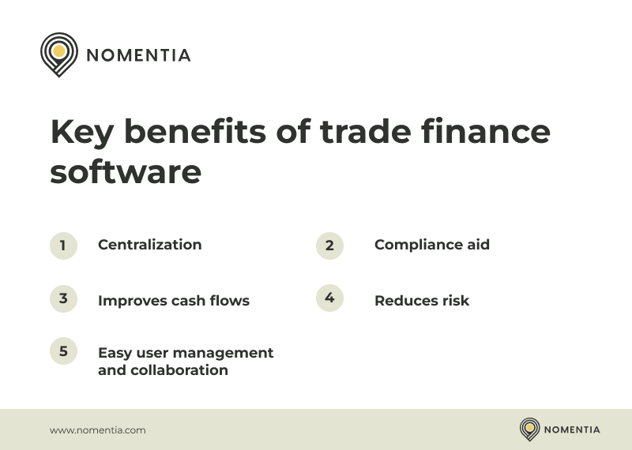

There are several benefits that trade finance software can have. These are some of the main benefits:

Centralization

The number one benefit of trade finance software is centralization. With software, you can typically view all documentation in one electronic place. This way, it becomes easier to have an overview of all trade finance instruments, in which stages they are, and whether any action needs to be taken.

Compliance aid

When the end-to-end trade finance processes are standardized and digitalized with the help of software, risk managers and compliance staff will have a much easier time remaining compliant. For example, software can keep track of all activities through audit trails, which makes it much easier to scrutinize the trade finance process and report on it for compliance purposes.

Improves cash flow operations

By tracking all trade finance documents centrally in a standardized format, you can quickly examine different stages that instruments or products are in, when products or services are delivered, and when payments or receivables are due. Hence, you can better forecast when resulting cash flow changes are expected to happen.

Reduces risk

You can significantly reduce risk by managing all trade finance matters with software. Proper trade financing management goes hand in hand with happier stakeholders, which can reduce the risk of losing an important customer or supplier. It can also guarantee that your own company gets paid on time or supplied with products in a timely manner to ensure business continuity.

Convenient user management and collaboration

Managing trade finance with an increasing number of contracts becomes very challenging. Especially when it involves different employee tasks at various stages of the trade finance lifecycle, some software can help streamline this by ensuring that different users are notified when their action is required. In addition, with the help of user rights, you can only show users the parts of the process that are most relevant to them.

6 best trade finance solutions

There are various trade finance software vendors on the market. To help you select the right vendors, we have shortlisted some of our favorites:

Note that the software providers are not presented in a particular order.

-

Nomentia

-

Finastra

-

Comarch

-

CGI

-

SureComp

-

Oracle

1. Nomentia

Nomentia is headquartered in Finland with offices all around Europe. They offer a complete SaaS cash & treasury management system and also allow customers to buy only the solutions they really require, including a trade finance solution.

Nomentia’s trade finance solution gives a complete overview of all your guarantees and letters of credit and their status at any time. It also allows comprehensive management of the entire trade finance instruments’ lifecycle in a centralized place without having to access different banks or other systems.

Using Nomentia, for example, globally designated employees can set up guarantees, and group treasury and trade finance teams can review, request modifications, and ask for more details — all through the same platform. At later stages, the guarantee can be accepted and signed digitally via DocuSign or other digital signature integrations, and documents can easily be sent to the bank using bank connectivity integrations. Once the guarantee has been granted, it will be stored under active guarantees until it expires when it is moved to the closed ones. As the solution is workflow-based, it can be fully tailored to the financial process requirements of the customer.

Would you like to learn more? Watch our 30-minute demo on guarantee management:

2. Finastra

Finastra is a London-based financial software company offering several financial solutions, including one for trade finance. With Finastra’s trade finance solution, you can manage trade finance instruments throughout their end-to-end lifecycle. In addition, you can request and document different types of instruments centrally and connect the solution to various banks.

3. Comarch

Comarch is a company headquartered in Poland and offers many different finance and IT services. Its solution for trade finance is used by several banks that can utilize Comarch’s solutions and offer them to their corporate clients to apply and manage guarantees, letters of credit, and collections.

4. CGI

CGI is a Canadian headquartered IT and consulting company with a trade finance solution called Trade360. The software mainly focuses on banks but can also benefit their corporate customers by managing global trade finance and supply chain operations with several banks and in different currencies. Process workflows facilitate centralization and automation. In addition, you can use Trade360 to centralize open account payments, purchase orders, invoice management and matching, and for supply chain financing options such as pre-shipment, receivables, post-shipment, and trade payables financing.

5. Surecomp

Surecomp is headquartered in Canada and is a provider that only offers trade finance solutions to banks and corporate customers. Their software, RIVO, centralizes trade finance instruments in a centralized hub. The key features include the management of letters of credit, guarantees, collections, and invoices.

6. Oracle

Oracle is a company headquartered in the United States and offers a wide range of IT services. Their trade finance software can manage trade finance operations centrally for a range of products, such as documentary credits, guarantees, and collections. With the solution, you can process trade finance instruments over their entire lifecycle.

Work with a trade finance solution provider that understands your processes

The right trade finance software vendor highly depends on your specific requirements and whether you plan to expand your technology stack to other solutions in the future. Therefore, remember to screen each vendor carefully. For example, some software is available through banks, which can be beneficial when you use one bank. Still, with several banks, it is better to look for a solution independent of banks that can connect to any bank globally.

As trade finance can be a complex task with many stakeholders included, it's essential that you are working with a provider that understands your trade finance processes and can tailor the solution to your needs. Another essential factor is to be able to manage user rights to ensure compliance by making sure that users have adequate rights according to the treasury or finance policy.

.png?width=750&height=153&name=guarantee%20management%20-%20banner%20(1).png)