Solutions

Payment reconciliation

Automatically compare financial records with bank statements and automate general ledger posting.

Zero manual work needed.

Reconcile all payments accurately

Ensure accuracy and transparency in your organization’s financial transactions

Gain control over all payments

Compare two sets of financial records like invoices and payments automatically to ensure payments are made and received.

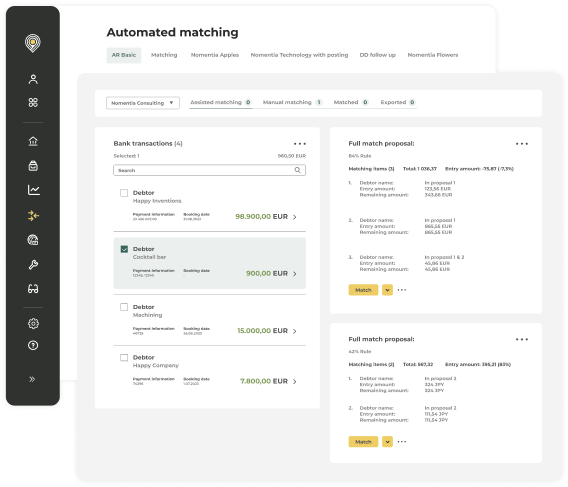

Automated matching

Streamline your processes, remove manual work and minimize errors by automatically matching payments and bank statements.

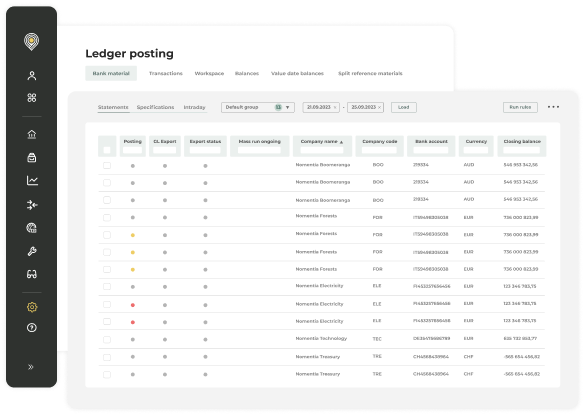

Automated posting

Automatically process and post a wide range of payment transactions to your accounting systems and update multiple general ledgers and sub-ledgers.

Enhanced security and compliance

Detect discrepancies and errors, prevent overpayments and underpayments and ensure accurate financial reporting and compliance.

Reconcile financial records

and transactions faster

Automated matching to speed up your work

Automated matching reduces manual effort, enhances accuracy, and speeds up processes, leading to improved operational efficiency.

- Automatically import open payment items from multiple source systems

- Define & implement multiple rule-based matching processes, such as balance matching, AR & AP matching, lockbox matching, e-commerce matching, and more

- Connect with your banks to fetch all your bank materials, such as bank statements, with detailed information on transactions

- Automatically identify and categorize bank transactions using a rule-based framework

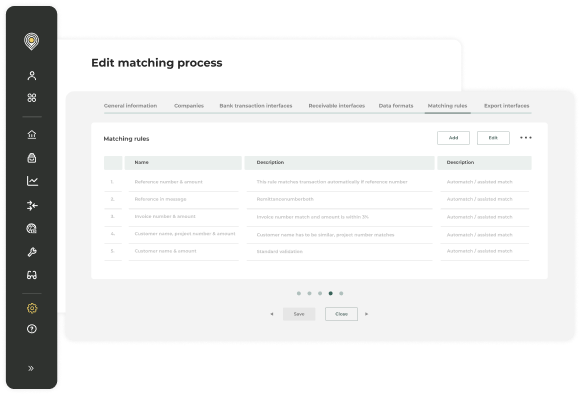

- Set your own rules for the matching process

- Use adjustable tolerances to eliminate the need for penny difference reconciliation

- Assisted matching supports exception handling

- Automatically enrich data from various sources to increase the percentage of automatically matched invoices

Continuously improve your matching processes

Understand the current level of unmatched transactions so that you can implement improvements to your processes.

- Implement reporting of unmatched records per entity

- Implement reporting per matching process

- Simple rule management: admin users can modify matching & posting rules themselves to tailor it to the organization’s needs

- Opportunity to continuously improve the matching processes and increase the automation ratio

- Reduce the need for manual searches & entering of missing data

- Utilize simple process documentation

Post items to accounting and general ledger systems

Automatically process and post a wide range of financial records and transactions to multiple accounting, general ledger or sub-ledger systems.

- Reconcile by matching bank account statement balances to your general ledger cash account balances

- Automate dimension imports and create new dimension values in a few simple clicks

- Easily manage and develop posting rules without needing IT support

- Exported items can be automatically saved in PDF format within Nomentia Archive

- Minimize mismatch between general ledger cash vs. bank account balances

- Posting to the general ledger:

- Recording detailed accounting transactions in the general ledger

- Involved aggregating financial transactions from where they are stored in specialized ledgers and transferring information into the general ledger

Trusted by 1400+ customers worldwide

Bas Meijer

Interim Treasury Manager, Greenchoice

Bas Meijer

Interim Treasury Manager, Greenchoice

Integrate with the tools

you rely on every day

Nomentia integrates with the banks, systems and tools you use everyday.

Find out more