-min.png)

-min.png)

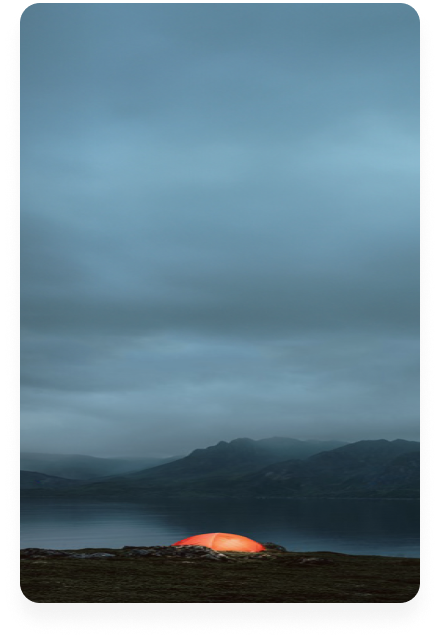

Integrating Nomentia Payments and SWIFT connectivity to harmonize global payment operations and cash flow control.

Company

About Nomentia

Product

Integrations

Customers

Customer Stories

Customer Service

Testimonials

Valmet

Payments integrated with the SWIFT Alliance Lite 2 cloud service, which enables global bank connections

Discover moreExperience Nomentia. Request a demo today.

See how Nomentia can simplify your workflows and empower your team – book your demo now.

Resources

Treasury Insights

Live & on-demand

Latest update

Nomentia & Enable Banking Partner to Provide PSD2 API Connectivity

Real-time cash visibility across 2500+ banks.

Company

About Nomentia

Customers

Discover how businesses like yours use Nomentia to design and implement better treasury processes.

Discover our customer success stories from different industries

-min.png)

-min.png)

Integrating Nomentia Payments and SWIFT connectivity to harmonize global payment operations and cash flow control.

Transforming cash visibility and liquidity forecasting with automation and centralized financial data.

Managing millions of payment flows with through scalable bank connectivity and centralized control.

Managing millions of payment flows with through scalable bank connectivity and centralized control.

.png)

.png)

Automating payments with while centralizing liquidity management and in-house bank practices.

.png)

Accessing group-wide treasury data in Excel with Nomentia Reporting for flexible analysis and control.

.png)

.png)

Combining speed, flexibility, and customer-driven development with to support treasury requirements.

.png)

.png)

Choosing as a flexible treasury partner with the right technical solution for evolving needs.

.png)

.png)

Improving FX exposure visibility and hedging efficiency with faster, data-driven calculations.

.png)

.png)

Improving forecast accuracy with while reducing the time needed for liquidity planning.

.png)

.png)

Supporting forecasting with Nomentia predictive analytics to improve decision-making in a volatile environment.

.png)

.png)

Bringing treasury data under control with through greater visibility, structure, and consistency.

.png)

.png)

Managing group-wide financial status and liquidity planning with professional control.

.png)

.png)

Improving cash visibility with through smooth data exchange and connected treasury reporting.

-min.png)

.png)

Processing payments from seven banks in one system with for stronger control and efficiency.

Automating intercompany loan workflows with to improve transparency, security, and compliance.

-min.png)

-min.png)

Making account confirmations fully automated with Nomentia to reduce manual work and increase control.

-min.png)

-min.png)

Gaining fast financial visibility into acquired subsidiaries to support integration and reporting.

-min.png)

-min-1.png)

Implementing to support a strong treasury focus on liquidity management and cash control.

.png)

.png)

Working with as a highly professional partner to support treasury transformation with commitment.

.png)

.png)

Achieving treasury transparency with across decentralized organizations in a simple, controlled way.

.png)

.png)

Treasury with Nomentia improves flexibility and strengthens daily financial operations.

.png)

.png)

Creating treasury transparency and flexible analysis across consolidated treasury data.

.png)

.png)

Running a robust, flexible treasury system that adapts quickly as business needs change.

.png)

.png)

Capturing account clearing, financial status, and cash flow forecasting data in one place.

.png)

.png)

Running payments and account processes with through reliable day-to-day treasury operations.

.png)

-min.png)

Saving time each month with Nomentia through simpler data management and automated invoice issuing.

-min.png)

-min.png)

Driving maximum automation with from project-related business processes to risk reporting.

-min.png)

-min.png)

Enabling risk and cost evaluation on a factual basis for stronger treasury decisions.

-min.png)

-min.png)

Implementing cash flow forecasting for 21 group companies in just 10 days.

-min.png)

-min.png)

Making liquidity management and cash flow forecasting a reliable part of daily operations.

-min.png)

-min.png)

Recommending software and services for strong product quality and treasury support.

-min.png)

-min.png)

Improving straight-through processing with Nomentia while securing the necessary operational coverage.

-min.png)

-min.png)

Reducing manual netting work with while improving efficiency across treasury and subsidiaries.

-min.png)

-min.png)

Providing clear group-wide visibility into guarantee issuance across treasury and subsidiaries.

-min.png)

-min.png)

Strengthening short-term cash flow management and improving cash flow forecasting accuracy.

Creating flexible integrations between internal systems and banking partners through middleware.

Replacing spreadsheet-based cash flow forecasting with Nomentia for greater control and reliability.

Turning weekly cash flow consolidation into a more efficient, reliable process.

Digitalizing key cash management processes in just three months.

Achieving treasury independence faster with structured processes and clear control.

Assessing FX risk quickly and simply with for clearer treasury decision-making.

.png)

.png)

Turning dispersed information into actionable treasury data with Nomentia.

Solutions:

Industries:

.png?width=80&height=80&name=img%20(74).png)

Stefan Schantl

Head of Investor Relations, ANDRITZ AG

![]()

“We now have an even more precise forecast which takes up even less of our time. Locally, colleagues can record adjustments to planned customer payments at project level while we in Group Treasury can check and validate everything with little effort.”

Stefan Schantl

Head of Investor Relations, ANDRITZ AG

Would you like to discover how we can assist your treasury team?