Solutions

Treasury Management

Streamline and improve all your treasury processes by implementing suitable solutions. Find options that integrate seamlessly into your existing technology stack to operate better.

.png?width=599&height=424&name=treaury-management-hero-img%20(1).png)

Be outstanding with our treasury management solutions

Treasury Reporting

Create central treasury reports based on data from any system or bank.

Learn moreLoan Management

Streamline loan management processes and incorporate loans into treasury reporting.

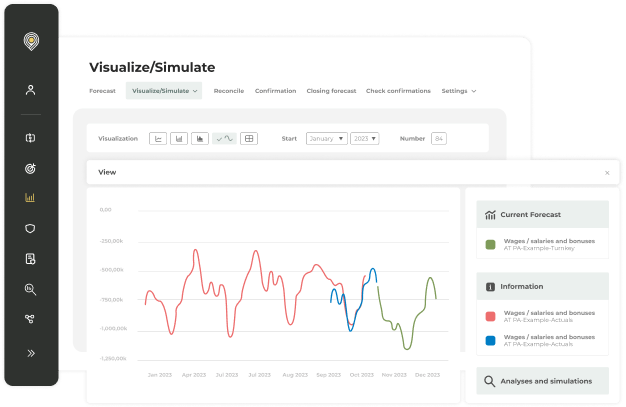

Learn moreCash Flow Forecasting

Automatically generate cash flow forecasts by consolidating global cash flow data from ERP systems, banks, treasury management systems, balance sheets, and more.

- Centralize cash flow forecasts by consolidating all data from any system or bank and analyzing all types of cash projections.

- Improve forecasting accuracy using machine learning to create scenarios based on historical data trends, seasonality, and industry-specific indicators.

- Utilize standard or customized reports with multiple time horizons

and filters, exporting data to other BI tools for deeper analysis. - Generate forecasts quickly by connecting systems and banks, consolidating data from different regions, divisions, or sub-groups.

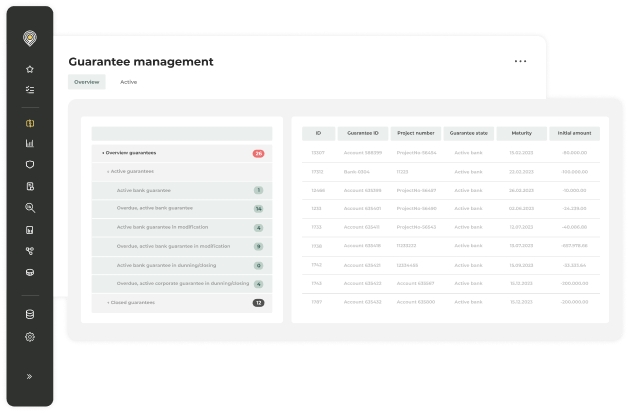

Guarantee Management

Automate and digitize guarantee management and letters of credit for instant group-wide visibility and status updates.

- Centrally manage global processes for guarantees and letters of credit (LCs) in one platform, with instant access to your group's bank guarantees.

- Use a single digital form for all requests and manage guarantee lifecycles entirely digitally, facilitating seamless communication within the platform.

- Digitize your bank communication for requesting, amending, and returning guarantees using SWIFT standard formats.

- Filter guarantees, report on bank fees, and utilize automated settlement and internal billing systems.

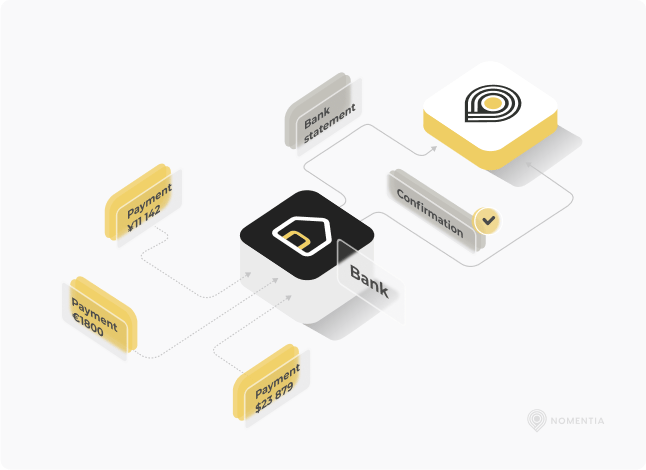

Bank Account Management

Retrieve, view, analyze and monitor cash flows, account statements, and payments centrally by connecting all your bank accounts to Nomentia Bank Account Management.

- Connecting all bank accounts to gain central visibility and control.

- Optimal user management with controlled user rights and full audit trail transparency supports compliance.

- Leverage comprehensive analysis options and filter by any relevant parameter based on group-wide account data.

- View opening and closing balances, intraday transactions, currency payments, and use balancing techniques for optimal cash management.

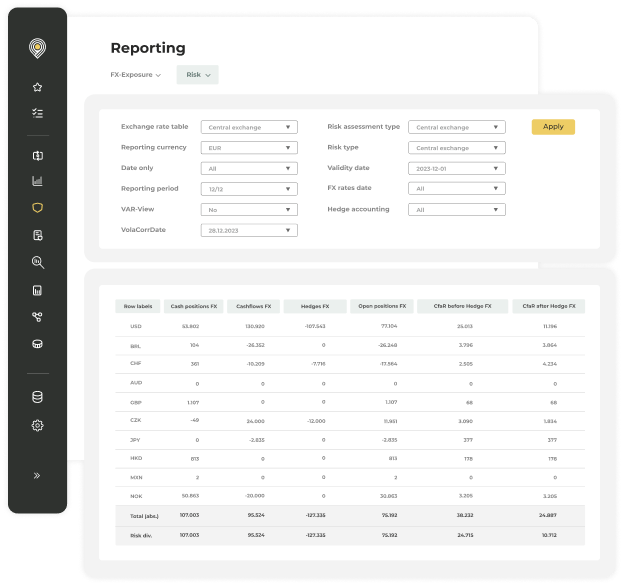

Treasury Reporting

Generate treasury reports by consolidating group-wide data from all systems and banks, and gain invaluable insights.

- Generate treasury reports from combined system and bank data, and analyze results in one place.

- Use simple filters from multiple systems and standard or custom interactive dashboards.

- Export reports to Excel with Nomentia Data Cube, Power BI, or other

BI tools for further analysis. - Automate report creation and track performance against company goals.

Loan Management

Optimize the management of external bank loans and intercompany loans and integrate them into treasury processes. Centralize and automate loan-related processes.

- Automatically include loan-related cash flow details in your forecasts and account for foreign currency loans in your FX exposure.

- Set up workflow-based processes to manage loans with maximal efficiency and according to best practices.

- Automate processes for fixed or floating external and intercompany loans, including various structures like bullet loans or repayment/annuity loans.

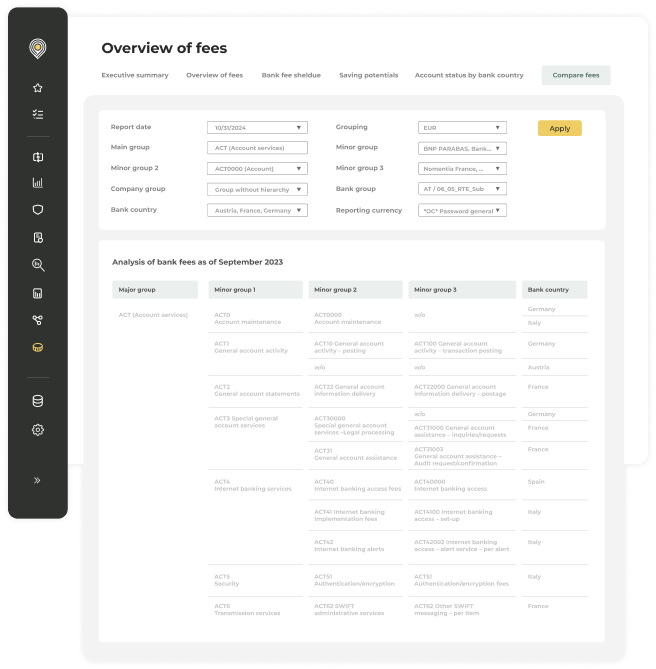

Bank Fee Analysis

Gain a clear understanding of bank fees to identify discrepancies between payments and invoices, empowering negotiations for better terms with banks.

- Run automated bank fee reports regularly to identify any deviations from your agreed bank fees.

- Collect data on fee types, volumes, and charges across all your bank fees to strengthen your negotiation position for upcoming requests for proposals (RFPs) with banks.

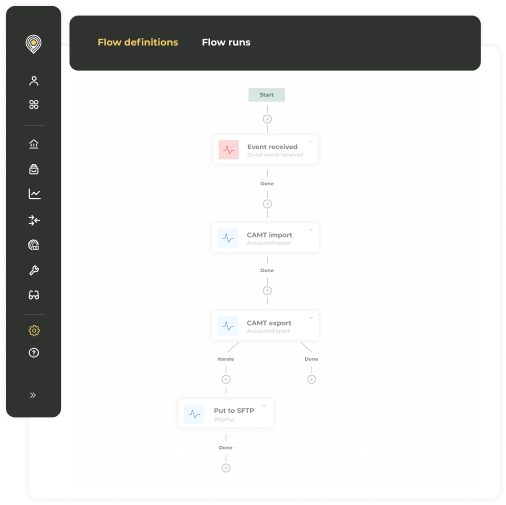

Treasury Workflows

Automate and centralize treasury processes with Nomentia Workflows, streamlining tasks across units and systems.

- Automate processes for guarantees, payments, intercompany loans, master data, derivatives, bank fees, and bank accounts.

- Centralize tasks across units, monitor processes, and stay updated on global workflow status.

- Automate task allocation with set rules and use role-specific reminders to eliminate queries.

- Fully integrated workflows that enable the automation of intersystem processes.

Discover our other solutions

Payment Hub

A complete payment hub for automating, managing, and centralizing local, cross-border, and global payments. Connect ERPs, financial systems, and banks to process all payments.

Reconciliation

Automatically match bank statements with transaction data or post transactions to the general ledger.

BAM

A centralized multibank solution to manage all your bank accounts. Retrieve, view, analyze and monitor cash flows, account statements, and payments centrally.

Cash flow forecasting

Automatically develop cash flow forecasts based on consolidated global cash flow data from all your systems and banks.

Guarantee management

Gain instant visibility into group-wide guarantees & LC status. Manage all processes related to internal and external guarantees in one platform.

Treasury reporting

Treasury reporting based on group-wide data from any system or bank. Easily export reports to BI tools or in other various formats if necessary.

Treasury workflows

Define workflows to streamline treasury processes. Centralize the work of various organizational units and multiple systems with Nomentia workflows.

Bank fee analysis

Automatically control and benchmark bank fees to avoid overcharges and ensure you don't pay the higher end of the market rates.

Loan management

Optimize the management of external bank loans and intercompany loans, integrate them into treasury processes, and measure their impact on cash flows and risk.

Risk management

Implement a structured and systematic approach to risk management and hedging. Identify key risk drivers and optimally manage FX and interest rate risk during your day-to-day trading activities.

Sanctions screening

Automatically catch payments to sanctioned beneficiaries before they are processed. Screen your outgoing payments against any type of sanction list.

Payment process controls

Built-in payment process controls for fraud prevention, treasury finance policies, and data validation. Automatically catch irregular payments before they are processed.

Security & compliance

- Login is available via multi-factor authentication or SSO

- Centralized user rights management allows you to gain better control over employee’s access based on their roles for SOX compliance

- Full audit trail & archive functionality to ensure compliance

- Nomentia Payments is hosted on Microsoft Azure to ensure highest possible security for your payment processing

- Nomentia holds the following certifications:

ISO/IEC 27001 Information Security Management System (ISMS),

ISAE 3402 TYPE 2 and SWIFT Certified Application (Cash Management for Corporates and CSP compliance)

Trusted by 1400 customers worldwide

Thomas Linnert

Head of Corporate Treasury Operations, Deutsche Lufthansa AG

Thomas Linnert

Head of Corporate Treasury Operations, Deutsche Lufthansa AG

Integrate with the tools

you rely on every day

Nomentia integrates with the banks, systems and tools you use everyday.

Find out more

FAQ

Do you have to take all treasury management solutions to get started?

No, you don’t have to take all our treasury management solutions. We understand that you may already have something in place. Our solutions can be integrated with your existing solutions.

Can I add more solutions later on?

Yes, you can! In fact, many of our clients start out with one or a few solutions and they add more as they go. We will be advising you from the beginning what’s the best way to start considering your plans and roadmaps.

Can Nomentia connect to any ERP system, and how is this connection implemented?

Nomentia integrates with the most popular ERP systems, such as SAP, Oracle NetSuite, Microsoft Dynamics, and more. Can’t find your ERP on the list? Leave us a message and tell more about your case and we’ll get back to you the soonest.

Leave a message

Do you offer solutions for cash management?

We provide a variety of solutions for cash management, such as bank connectivity as a service, liquidity management, in-house bank and cash visibility. Read more about our cash management solution.

Cash Management solution

How can I manage guarantees in Nomentia?

With Nomentia, you can manage all internal and external guarantees and handle end-to-end guarantee processes in one place. You can easily track, modify, and review guarantees and their statuses for complete transparency.

Nomentia Guarantee Management

How can I generate cash flow forecasts, and where does the data come from?

With our Nomentia Cash Flow Forecasting solution you can automatically generate cash flow forecasts by consolidating global cash flow data from ERP systems, banks, treasury management systems, balance sheets, and more to analyze all types of cash projections.

Nomentia Cash Flow Forecasting