Solutions

Cash Management

Streamline your cash flow with our variety of cash management solutions. Explore what solutions you could integrate into your existing processes.

.png?width=619&height=487&name=cash-management-hero-img%20(1).png)

Be outstanding with our cash management solutions

Bank Connectivity as a Service

We will deliver fully managed bank connections and file format conversions to you to enable communication between your banks and ERP- and other financial systems.

- Connect with banks across the globe through host-to-host connections, local connections (EBICS), or SWIFT Alliance Lite2 for Business.

- Two-way communication between your banks and treasury management system, any other financial systems, or ERP(s).

- We can help to create integrations between your banks and your systems whenever necessary.

- The bank connectivity as a service solution can be used without using other Nomentia solutions.

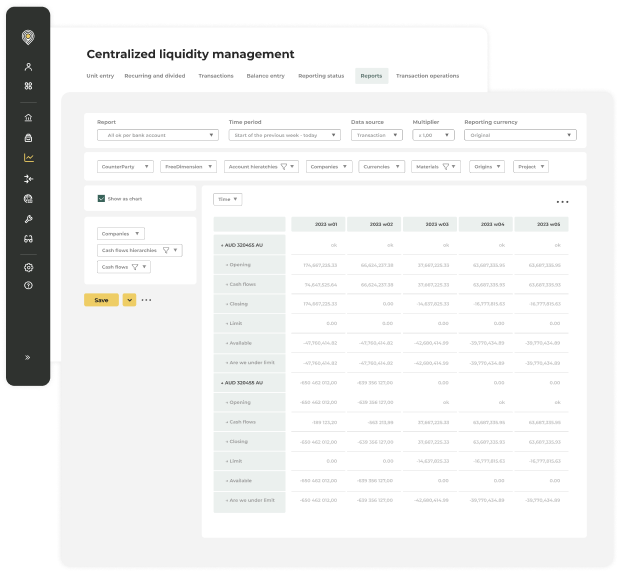

Liquidity Management

Consolidate all cash flow data and maximize visibility into your organization’s liquidity, cash flows, and FX positions to optimize external & internal funding.

- Automatically collect data from all your subsidiaries and using all cash flow data get visibility into your company’s cash positions.

- Monitor global cash positions across entities, business units, multiple banks, and systems

- Fully customizable dashboards help you to create comprehensive cash flow reports both for short- and long-term.

- Connect with any ERP system, for example, SAP, Oracle, Microsoft, Sage, NetSuite, and more to collect all data from various sources.

In-House Bank

Manage your cash management processes such as payments, collections, FX risk, IC loans, and liquidity all in one place with fewer external bank accounts.

- Implement a complete payment hub within the in-house bank to go from manual payment processes to full automation.

- You can implement the payment-on-behalf-of (POBO) and collection-on-behalf-of (COBO) processes.

- Get complete visibility into the company’s cash positions throughout the entire organization.

- Effective central liquidity management helps mitigate financial risk.

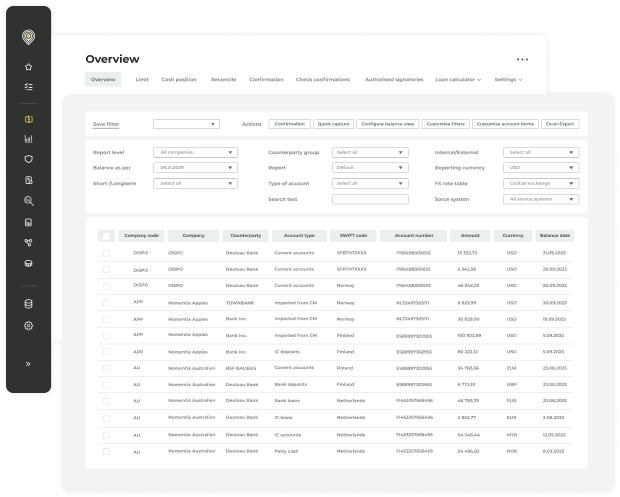

Cash Visibility

Monitor global cash positions in Nomentia’s centralized cash visibility solution.

- Gain instant transparency into global cash positions.

- Easily create reports and analyze them in detail.

- Analyze any cash flow data at any level.

Discover all our other solutions

Payment Hub

A complete payment hub for automating, managing, and centralizing local, cross-border, and global payments. Connect ERPs, financial systems, and banks to process all payments.

Reconciliation

Automatically match bank statements with transaction data or post transactions to the general ledger.

BAM

A centralized multibank solution to manage all your bank accounts. Retrieve, view, analyze and monitor cash flows, account statements, and payments centrally.

Cash flow forecasting

Automatically develop cash flow forecasts based on consolidated global cash flow data from all your systems and banks.

Guarantee management

Gain instant visibility into group-wide guarantees & LC status. Manage all processes related to internal and external guarantees in one platform.

Treasury reporting

Treasury reporting based on group-wide data from any system or bank. Easily export reports to BI tools or in other various formats if necessary.

Treasury workflows

Define workflows to streamline treasury processes. Centralize the work of various organizational units and multiple systems with Nomentia workflows.

Bank fee analysis

Automatically control and benchmark bank fees to avoid overcharges and ensure you don't pay the higher end of the market rates.

Loan management

Optimize the management of external bank loans and intercompany loans, integrate them into treasury processes, and measure their impact on cash flows and risk.

Risk management

Implement a structured and systematic approach to risk management and hedging. Identify key risk drivers and optimally manage FX and interest rate risk during your day-to-day trading activities.

Sanctions screening

Automatically catch payments to sanctioned beneficiaries before they are processed. Screen your outgoing payments against any type of sanction list.

Payment process controls

Built-in payment process controls for fraud prevention, treasury finance policies, and data validation. Automatically catch irregular payments before they are processed.

Security & compliance

- Login is available via multi-factor authentication or SSO

- Centralized user rights management allows you to gain better control over employee’s access based on their roles for SOX compliance

- Full audit trail & archive functionality to ensure compliance

- Nomentia Payments is hosted on Microsoft Azure to ensure highest possible security for your payment processing

- Nomentia holds the following certifications:

ISO/IEC 27001 Information Security Management System (ISMS),

ISAE 3402 TYPE 2 and SWIFT Certified Application (Cash Management for Corporates and CSP compliance)

.png?width=1354&height=813&name=Frame%202376%20(1).png)

Trusted by 1400 customers worldwide

Ruth Leopold

Head of Treasury, VDM Metals

Ruth Leopold

Head of Treasury, VDM Metals

Integrate with the tools

you rely on every day

Nomentia integrates with the banks, systems and tools you use everyday.

Find out more

FAQ

Do you have to take all cash management solutions to get started?

Can I add more solutions later on?

Yes, you can! In fact, many of our clients start out with one or a few solutions and they add more as they go. We will be advising you from the beginning what’s the best way to start considering your plans and roadmaps.

Can Nomentia connect to any ERP system, and how is this connection implemented?

Nomentia integrates with the most popular ERP systems, such as SAP, Oracle NetSuite, Microsoft Dynamics, and more. Can’t find your ERP on the list? Leave us a message and tell us more about your case and we’ll get back to you the soonest.

Leave a message

What options does Nomentia offer for connecting to banks?

Working with Nomentia, you can connect with over 10 000 banks globally. We can connect you with over 100 banks directly (using host-to-host connections) and with the rest via Swift. We also provide local connectivity options, such as EBICS. Read more about our bank connectivity solution and here you will find more information about Swift.

Swift Business Connect

How does Nomentia handle the requirement to support different payment formats for each country?

We can work with any payment file format that you have whether it’s a common format like JSON or proprietary in-house format. We will make sure that the bank gets your messages in their preferred ISO20022 XML format and you will receive confirmation from the banks in your preferred format.

Learn more

Do you offer solutions for treasury management?

We provide a variety of solutions for treasury management, such as predictive analytics for cash flow forecasting, treasury workflows, treasury reporting, guarantee management, bank fee analysis, FX risk management, loan management and more. Read more about our treasury management solutions.

Treasury Management solution