Intercompany payment processes often become complicated when organizations have operations in multiple countries. It means that payments need to be made globally, in various currencies, and often from various bank accounts since no bank can cover accounts for all business units or subsidiaries globally. The result: tens, hundreds, or thousands of bank accounts to be managed, more intercompany transactions than necessary, increased transaction costs, higher FX rates, and FX exposure, to mention only a few.

Intercompany netting solutions have been designed to tackle some of the challenges that global intercompany settlements bring. Treasury management system vendors typically provide these solutions, and some banks have netting capabilities, too, like Citi Bank.

Let's dive deeper into intercompany netting, how it works, its benefits, and how it compares to setups without any solutions in place or with an in-house bank.

What is intercompany netting and how does it work?

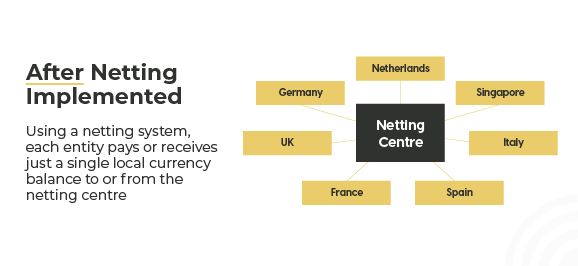

Simply put, organizations that have implemented intercompany netting have a netting center (or clearing house) that each subsidiary or business unit makes payments to or receives payments from based on the net obligations from all subsidiaries in the organization between each other.

The netting process

In practice, subsidiaries, SSCs, accountants, treasury, and other users can all access the netting system where their transactions are uploaded. The information is regularly reviewed and processed, often on a monthly basis. After the review, settlements are made, netting statements are delivered, and FX rates and deals are fixed. The transactions are netted to one amount to each subsidiary in its local currency and can be transferred to both a physical bank and an in-house bank (cashless wherever possible).

The netting process is easier to demonstrate by comparing the methods without a netting solution to where companies have implemented one.

Without an intercompany netting solution

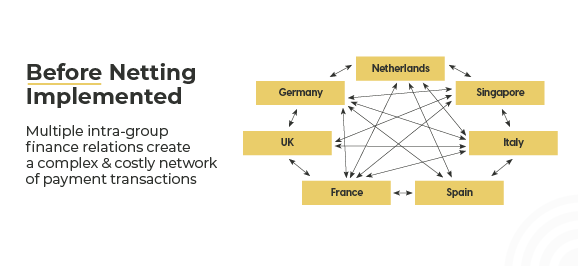

The image below shows an organization with various subsidiaries in different countries with complex and costly intercompany transaction processes. Money is going back and forth between each unit, with high incurred costs since an unnecessarily high number of transactions and FX conversions are made.

In short, without netting, intra-group transactions are inefficient and come with quite some downsides:

-

Costs of transfers are high

-

There’s no disciplinary process for payments

-

There are many costly FX deals on the subsidiary level

-

It can cause challenges with intercompany reconciliation

-

It can also lead to unresolved disputes between subsidiaries

-

It's more challenging to gain visibility due to decentralization

-

Without netting, more intercompany communication is required, which is time-consuming.

With a solution implemented

You can compare the situation in the previous image to the image below, which shows a company's processes with an intercompany netting solution.

After the implementation of an intercompany netting solution, companies experience many benefits:

-

Processes are standardized, simplified, and controlled centrally

-

Improved timeliness of payments

-

Fewer transactions mean lower transactions costs

-

FX management is centralized, and accumulated remaining FX is traded at larger volumes, allowing more favorable rates

-

Usually, fewer banks are required, which reduces the float

-

Netting solutions provide better central visibility into all intercompany transactions

The pros and cons of netting

On the one hand, intercompany netting solutions can significantly reduce your FX spread cost, help lower wire transfer costs, reduce float, and lessen administrative work and disputes among subsidiaries. On top of that, it can be beneficial for cash flow forecasting due to the central visibility of payables and receivables of all subsidiaries.

On the other hand, a netting solution also means an initial investment in a tool for which you typically need to build a business case. Also, some of the administrative work that subsidiaries previously did becomes the task of the HQ’s treasury team since they will centrally control it.

Intercompany netting is allowed in most countries, but there are some exceptions due to regulations, such as in countries like China, Brazil, South Korea, and India, where netting is only allowed in the country’s own currency, for example. So before buying a tool, it’s good to review whether netting is possible in the markets where you have active operations.

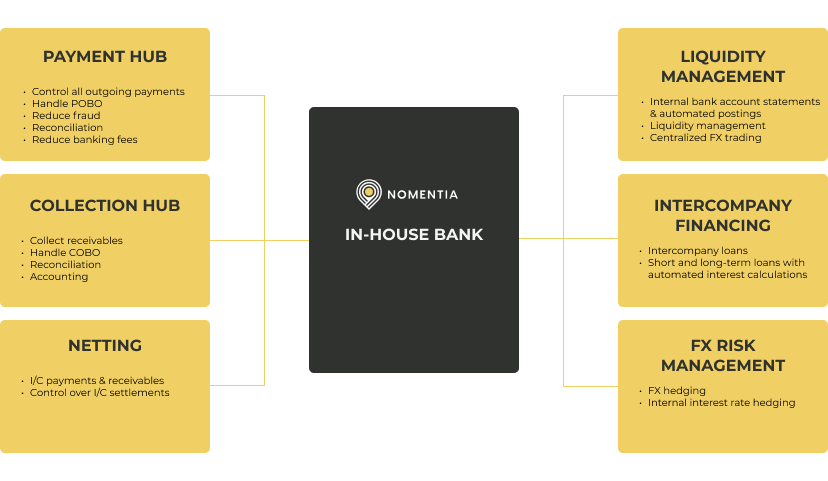

Is intercompany netting the right solution or should you consider an in-house bank?

If your organization is challenged with managing multiple subsidiaries and currencies and a large number of intercompany payments, it can make sense to look into netting solutions. However, we’ve noticed that future-proof treasury teams often consider cash pooling and netting as building blocks for better operation efficiency. As a result, they are more drawn to in-house banks that are more modern alternatives to only a netting system, and they can tackle much more than just netting. In-house banks are usually also part of a wider TMS that can offer additional valuable modules if your system requirements evolve over time.

Ultimately, what solution they want to adopt depends on each company individually. We wrote two articles dedicated to in-house banking that you can read to decide whether it is a viable alternative to solely a netting system for you:

1. The rise of the in-house bank and why group treasurers are adapting it