What should treasurers look for in banks offering premium APIs?

In the first two articles of our banking API series, we have been through topics like why treasury and finance professionals should not build their own APIs and the state of APIs from a customer experience point of view.

In this article, we decided to collect the banks that are forerunners in creating banking APIs in corporate. While the offerings broadly vary bank by bank, we will focus on banks that are leaders in providing a great experience – not only for developers but also for corporates and cash and treasury management solution providers.

1. OP

As a cash management solution provider from the Nordics, OP had to be on the very top of our list. Nordic banks are known for their innovativeness, and OP is no exception. When you visit OP’s website to learn about their API solutions for corporate banking, you find more than solely just developer information on how to set up the API.

OP understands that the customer experience is a must, and for executing payments, real-time solutions are the easiest to manage with APIs. No wonder OP’s API is in popular demand, and they have around 40 000 API calls daily transferring payments to 30 countries.

OP provides the following APIs for corporates:

- OP Corporate Account Data API to view up-to-date account balances and retrieve transactions

- OP Corporate Payment API to initiate SEPA transfers and instant payments from the company’s bank account

- OP Corporate Transaction Filter API to filter transactions and provide excellent customer service to clients inquiring about payments

- OP Corporate Transaction Info API to ask for further information on a payment

- OP Corporate Refund API to refund payments based on the details of the original payment received

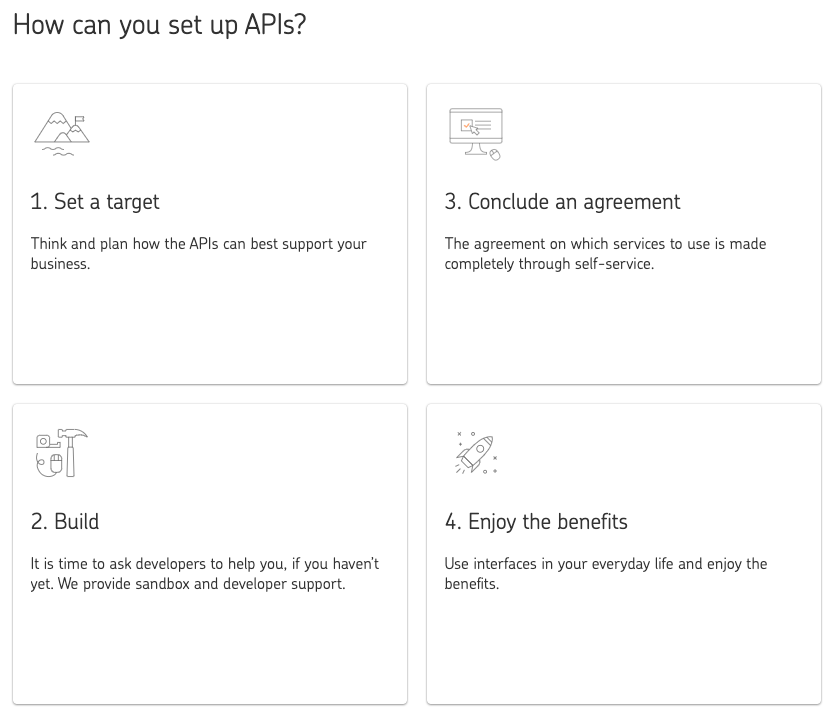

Setting up APIs with OP is easy – once you have planned which APIs you need, you can conclude an agreement online through a self-service page and start building it. Perhaps the best part of working with OP is that the bank works with solution providers, so if you don’t want to build your APIs yourself, the solution providers can do this on your behalf.

2. Nordea

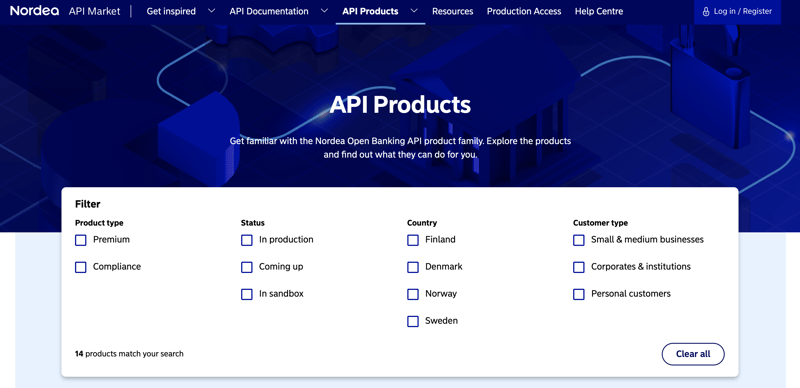

Nordea is another Nordic bank with innovative and forward-thinking API solutions. Nordea’s API portal will remind you of the AppStore and you can easily find information on what you need.

Nordea offers both premium services and services that are enough for those that want to meet compliance. The API products can also be divided by customer type, and there are APIs for small & medium businesses, corporates & institutions, and personal customers.

The premium solutions that Nordea offers for corporates are the following:

- Beneficiary Account Validation

- Corporate Payout

- FX Trading

- Instant Reporting

- Loan Broker

- Mass Payments

Diving more profound into the mass payments. As a payment hub provider, it’s interesting to see what the banks offer for corporate cash management. This API helps corporate customers to make pre-signed multiple payments through one API request. In addition, with this API, customers can automate and improve how they execute accounts payables (AP).

The Mass Payments API promises the customer to reduce processes related to manual payments and provide full transparency and automation. Nordea works with the client to get the API up and running, and as a first step, they release a test API to test that it fits the customer’s need. The API also comes with a Corporate Access Authorization API. These APIs have excellent developer documentation, just like other Nordea API products. However, to make the life of finance people easier, it would be great to see videos and more practical explanations of how the API would work in reality. It’s best to get in touch with the bank and see a demo to get answers to all of your questions.

3. ING

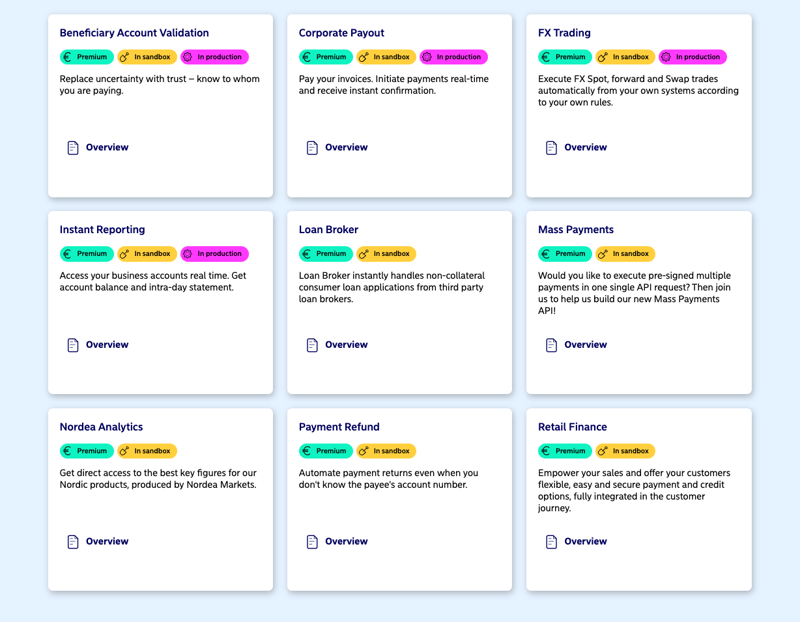

ING has an excellent developer portal where they offer the following API solutions for corporates:

- Account Information API

- Confirmation Availability of Funds API

- OAuth 2.0 API

- Payment Initiation API

- Payment Request API

- Showcase API

Diving deeper into the APIs, each API has References and in-depth documentation for developers. In addition, ING has done an excellent job at explaining what functionalities the API has to make the cash manager’s job easier to understand whether this solution is for them. The bank offers both premium solutions and solutions for PSD2 compliancy for corporates.

To get a more tangible view of the ING API offering, the bank has gathered a few short customer cases to help corporates understand the use cases.

4. SEB

Another Nordic bank has made it to our list of providing excellent API products for corporates. SEB has a strong understanding of how important the customer experience can be. They are not only pioneering corporate premium APIs, but they have also just partnered with Nomentia to provide bank connectivity to their clients to help with the P27 transition in the coming years.

Back to the APIs, they are providing the following products via the SEB Developer Portal:

- Authorization

- Corporate occupational pension engagement

- Corporate occupational pension invoice

- Foreign exchange rates

- Foreign exchange trading

- Global custody positions

- Global custody safekeeping account information

- Pension and insurance leads

- PSD2 Account information

- PSD2 Branded Cards

- PSD2 Payment Initiation

- Real estate leads

- SEB base rates

- SEB Jira IT service management

For developers, they also have a GitHub Community, which is a thoughtful way of supporting developers in building APIs.

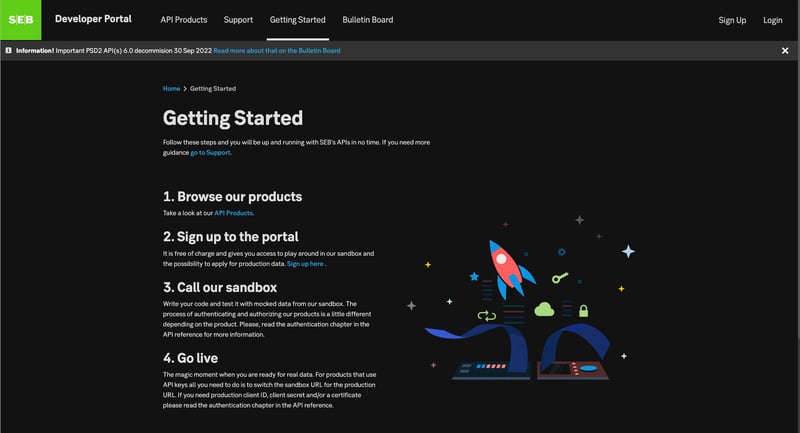

The site is less focused on the corporate customer experience. Still, you will have a lot of information about API development within SEB and a clear overview of how to get started.

5. Deutsche Bank

The last one on our list is Deutsche Bank, they are not only a leader in providing a comprehensive developer experience and a rich API scope according to Innopay’s benchmark, but they are a master in openness.

What does Deutsche Bank offer to clients in the DACH region?

Deutsche Bank offers solutions for PSD2 compliance, they have an API partner network, db Smart Access, and DB Corporate API: Instant Payments.

Browsing the bank’s developer portal, customers get information about data security at Deutsche Bank API program which is a critical decision-making factor for corporates that must be compliant.

German speakers can also get more in-depth information on how customers are using the APIs for their benefit.

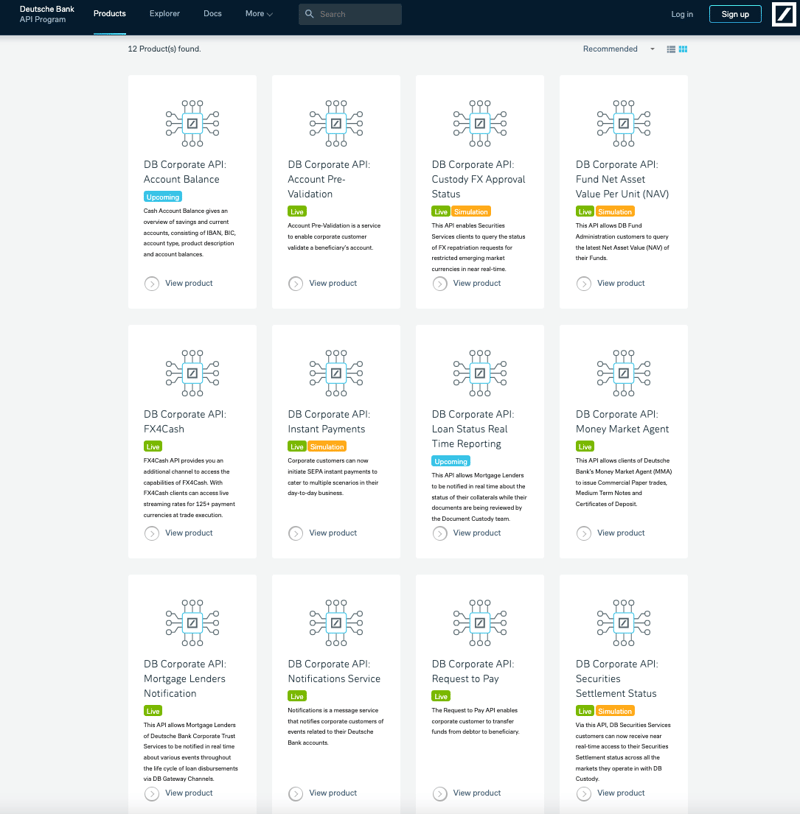

When we are looking at the products, Deutsche Bank Allows us to filter which solutions we would need:

- Deutsche Bank Private Bank

- Deutsche Bank Corporate Bank (SME)

- Deutsche Bank Enterprises

- Norisbank

Additional filters include state, category, region, and authorization method.

For enterprises, the following APIs are available:

- DB Corporate API: Account balance

- DB Corporate API: Account-Pre-Validation

- DB Corporate API: Custody FX Approval Status

- DB Corporate API: Fund Net Asset Value Per Unit (NAV)

- DB Corporate API: FX4Cash

- DB Corporate API: Instant Payments

- DB Corporate API: Loan Status Real-Time Reporting

- DB Corporate API: Money Market Agent

- DB Corporate API: Mortgage Lenders Notification

- DB Corporate API: Notifications Service

- DB Corporate API: Request to Pay

- DB Corporate API: Securities Settlement Status

When looking into each product, there is a clear description for the customer of what they can achieve with each API, and there is also a description of the process to explain what it would take to get the API calls running.

Overall, it’s an excellent offering from the bank, yet, it would be great to get even more information on how it helps corporate treasury and finance teams.

Premium API offerings are getting better and better

We could have added many more banks to the list also outside of Europe. It’s great to see how some banks are clearly taking the lead on offering Premium APIs for corporate clients to help them with their cash management challenges.

Perhaps in the future, we will see even more innovative APIs appearing on the market and complete suites of API offerings for cash and treasury management. We also expect that many banks will start partnering with TMS providers and connect APIs to their solutions so that the end-users can always have real-time data at their disposal.

One thing is for sure: we will continue to follow how the market develops and we are always open to partnering with banks to provide outstanding customer experiences to our mutual clients.